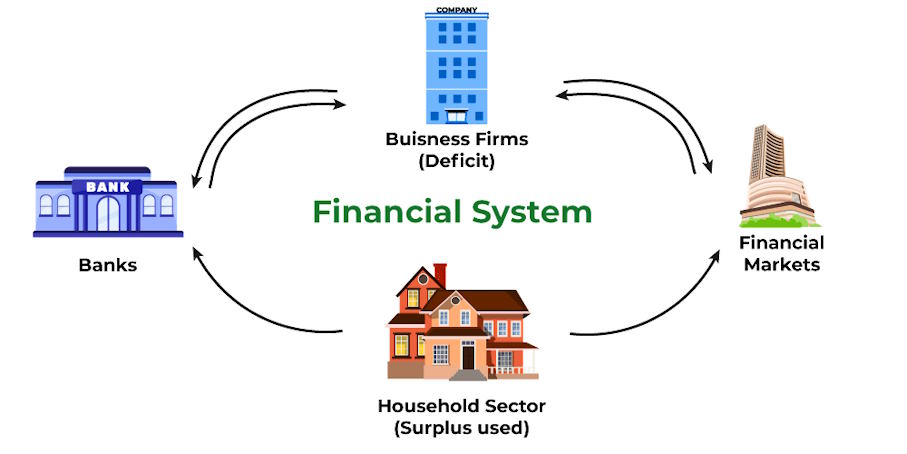

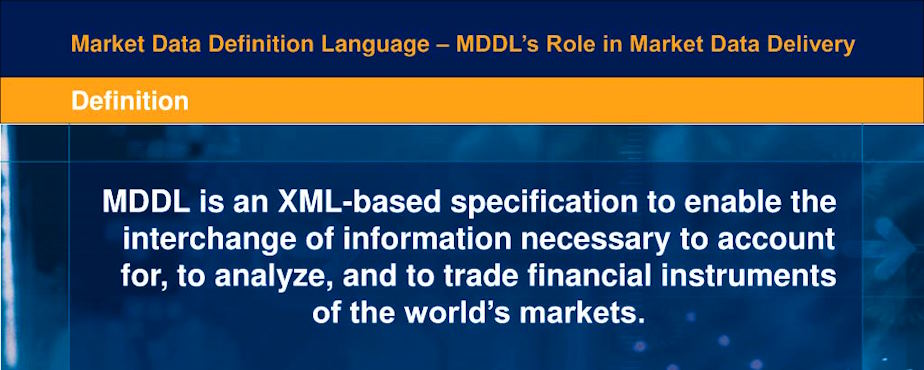

The financial markets thrive on the seamless exchange and analysis of vast amounts of data. Market Data Definition Language (MDDL) plays a crucial role in ensuring this data is efficiently and accurately communicated among participants. This article explores MDDL’s impact on financial market efficiency, its benefits for market participants, and its role in data interoperability.

MDDL’s Impact on Financial Market Efficiency

MDDL enhances the efficiency of financial markets by standardizing data formats, which simplifies data exchange processes. This standardization reduces the time and resources needed for data interpretation, allowing market participants to make quicker and more informed decisions.

- Standardization: MDDL provides a common framework for data representation, reducing discrepancies and enhancing data accuracy. When data is presented in a uniform manner, it minimizes the chances of misinterpretation and errors.

- Speed: By streamlining data processing, MDDL helps in quicker dissemination and analysis of market information. This is critical in financial markets where timely data can make the difference between profit and loss.

- Cost Reduction: Standardized data formats reduce the need for costly custom integration solutions, lowering operational costs for market participants. Firms no longer need to spend extensively on developing bespoke solutions to handle data from different sources.

Benefits of MDDL for Financial Market Participants

Market participants, including brokers, traders, and analysts, benefit significantly from the implementation of MDDL. The language offers a structured approach to data management, leading to more efficient trading strategies and better risk management.

- Enhanced Data Quality: MDDL ensures that the data received is complete and reliable, reducing the risk of errors. High-quality data is paramount in making sound financial decisions.

- Improved Trading Strategies: With accurate and timely data, traders can develop more effective strategies, enhancing their competitive edge. The ability to quickly analyze and react to market data gives traders a significant advantage.

- Risk Management: Reliable data allows for better assessment and management of market risks, contributing to more stable financial operations. Accurate data is essential for identifying potential risks and taking preemptive measures to mitigate them.

MDDL and Data Interoperability in Financial Markets

Data interoperability is critical in the financial markets, where numerous systems and platforms need to communicate effectively. MDDL facilitates this interoperability by providing a standardized language that different systems can understand and use.

- Seamless Integration: MDDL enables different financial systems to integrate seamlessly, ensuring smooth data flow across platforms. This integration is essential for the efficient operation of complex financial ecosystems.

- Consistency: The standardized nature of MDDL ensures consistent data interpretation across various applications and institutions. Consistent data interpretation reduces errors and enhances trust in the data.

- Future-Proofing: As financial markets evolve, MDDL’s flexibility allows it to adapt to new data types and requirements, ensuring long-term viability. This adaptability ensures that MDDL can continue to meet the needs of the financial industry as it grows and changes.

MDDL plays a pivotal role in enhancing the efficiency, interoperability, and overall functionality of financial markets. By providing a standardized framework for data exchange, MDDL not only benefits market participants through improved data quality and reduced costs but also ensures the seamless integration of various financial systems. As financial markets continue to grow and evolve, the importance of MDDL in maintaining efficient and accurate data communication will only increase, underscoring its critical role in the industry. The implementation of MDDL represents a significant step forward in the quest for more efficient, reliable, and integrated financial markets.